If your business is registered in Hong Kong, you eventually will have to pay profits tax as soon as your company turns profitable. When the Inland Revenue Department sends you a notice to communicate your company’s profits for a certain the financial year, your auditor will provide the tax computations to the Inland Revenue department. Afterwards, you’ll a letter from the Inland Revenue Department (IRD) with instructions to pay profits tax.

In this article, we will discuss how Profits Tax can be paid through online internet banking. This is often times, the most convenient way for business to pay Profit Tax, especially if you’re not based in Hong Kong yourself.

PROFIT TAX PAYMENT VOUCHERS

When you receive a notification to pay your profits tax, the letter from the IRD will include ‘payment vouchers’. This could be 1 or multiple vouchers depending on how large the tax amount is. Note the ‘shroff account number’ which you will find on the voucher. This number is needed later when you submit a payment inside your internet banking account.

PAY PROFITS TAX THROUGH INTERNET BANKING IN HONG KONG

To demonstrate how you can pay the tax invoice, we will use HSBC as an example, since that’s the most often used bank by businesses in Hong Kong.

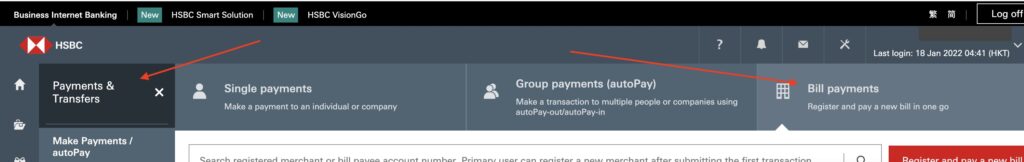

After you login your business banking account. You have to go to: Payments & Transfers -> Bill Payments

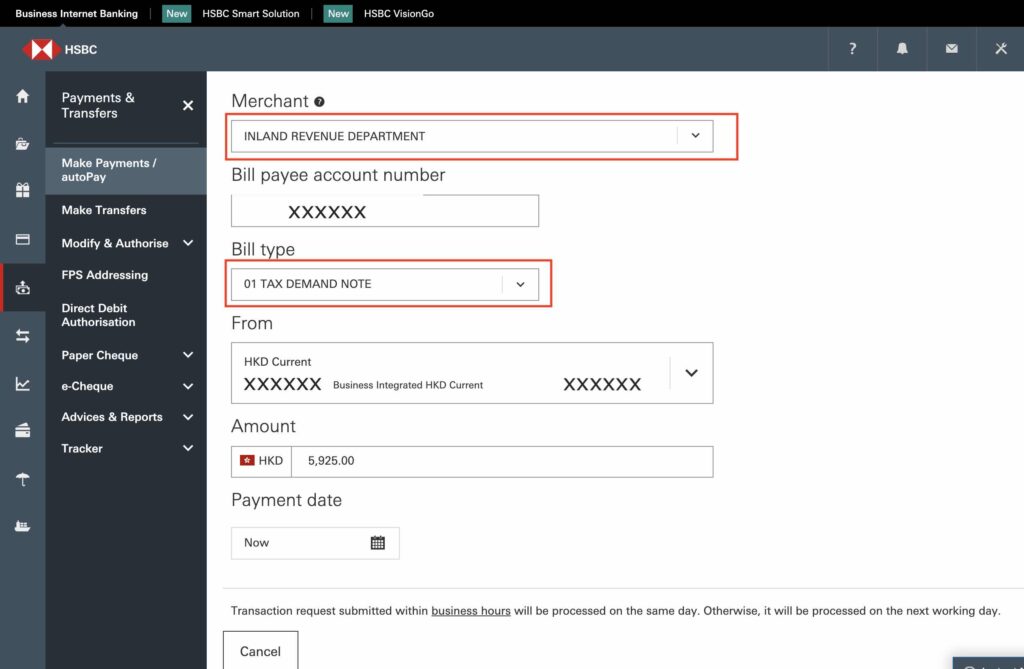

Once you are on the Bill Payments page, please look up the Merchant/payee name ‘INLAND REVENUE DEPARTMENT’

In the ‘Bill payee account number’ field, fill in the ‘shroff account number’ on the invoice. In ‘Bill type’, select type ‘Tax Demand Note’.

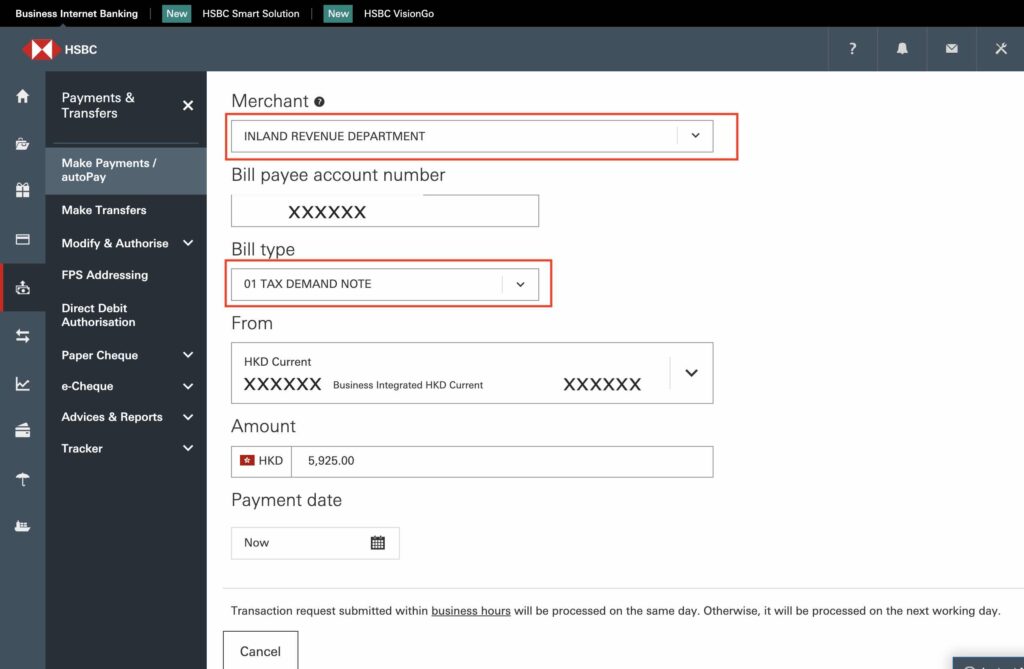

The select your account that you want to use, and fill in the amount. Make sure the selected account has sufficient funds to pay the tax amount. Select a suitable payment date, or keep it as ‘now’. Now click further to preview the payment. This is how it should look:

On the preview page, please check if the amount is correct and if the payee shroff account number is correct. If so, you can proceed and confirm the payment.

On the confirmation page, make sure to click the print icon, and click save as PDF to make sure you have a copy of the payment slip for future reference.

That’s it! If there are any questions, feel free to ask!

Note: this information is for reference only. You may use this information, but we will not accept any responsibility.

No Comments